Basic Tax Information

Taxes in the United States are reconciled each April with the Internal Revenue Service (IRS) for the previous tax year. The filing deadline for the 2025 calendar year is April 15, 2026. To help ensure a successful tax season, please review the important information below.

If you are a new student for the Spring 2026 semester who arrived in December 2025 (approximately one month ago), you are required to file Form 8843 because you were physically present in the United States during 2025—even if it was only for a few days in December.

Tax Filing with Sprintax Calculus

YSU is currently using Sprintax Calculus, a nonresident alien tax compliance software, to ensure compliance with U.S. tax withholding and reporting regulations.

Students who received housing scholarships during calendar year 2025 have been set up with a user account in Sprintax Calculus. You will receive an email directly from Sprintax Calculus with instructions to activate your account.

Once activated, Sprintax Calculus will ask you to provide information regarding your residency status, personal details, contact information, and payments received. Based on the information provided, the system will generate a residency determination (Nonresident Alien or Resident Alien for tax purposes) and inform you whether you are eligible to claim any applicable tax treaty benefits.

If you have received an email from Sprintax Calculus, please follow the directions to:

- Activate your account

- Complete your residency questionnaire

- Set yourself up for a successful 2025 tax season

Please reach out to controllersoffice@ysu.edu if you cannot access your Sprintax account.

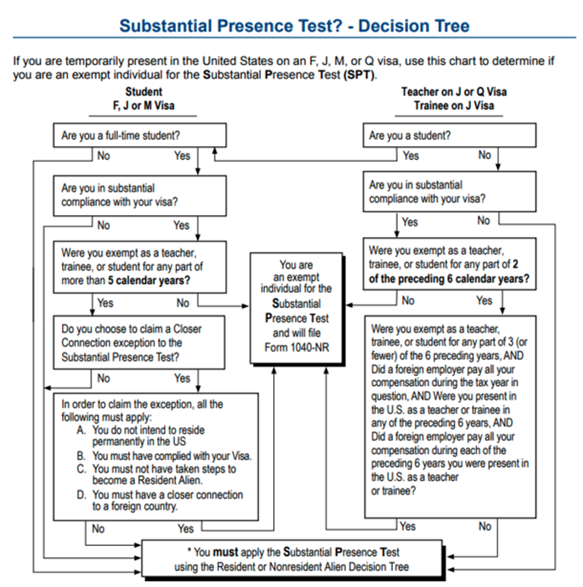

Determining Your Tax filing Status

Most international students are considered nonresidents for tax purposes. To determine your tax status, you may use the following decision tree from the Internal Revenue Service:

⚠️ International students who are non-residents for tax purposes should NOT use TurboTax and should NOT take their taxes to an off-campus tax preparation agency – there is a high probability that those agencies do not have expertise in non-resident taxes and will likely prepare the wrong forms.

❗ Non-residents for tax purposes CANNOT claim the American Opportunity Tax credit (1098-T). Filing for that credit constitutes knowingly filing a false tax return and carries severe penalties. If you are a non-resident for tax purposes and received the 1098-T from YSU in the mail/email, you should disregard this form.

Tips for a Successful Tax Season:

Be Informed.

General information on non-resident taxes can be found on the IRS website and in the IRS Publication 519 (U.S. Tax Guide for Aliens). In general, for federal tax filing, F-1 and J-1 students are considered to be non-residents for tax purposes for the first 5 tax years in the U.S. Therefore, if you have been in the U.S. for 5 or less tax years, you are likely a non-resident for tax purposes. Non-residents for tax purposes are exempt from the FICA taxes. To determine tax residency, it is best to refer to the Internal Revenue Service (www.irs.gov).All F-1 and J-1 students and their F-2/ J-2 dependents who are non-residents for tax purposes must file at least the Form 8843. This form is required for all F-1/ J-1 and F-2/ J-2 non-residents for tax purposes, including new students during the Spring 2026 Semester, who were physically present in the U.S. in 2025, regardless of whether or not you had income in the U.S. in 2025. You can expect future communication from the International Programs Office regarding upcoming information sessions, which will include instructions for filing the Form 8843.

Stay organized! Gather all forms that are required to file your tax return.

In January/February 2026, employers and financial institutions did or will send out important tax forms in the mail. Keep all of these forms! You will need to prepare your tax return(s).If you worked on campus as a YSU student employee, an electronic copy of your W-2 will be available (1/31/2026) in your Penguin Portal (look for “Taxes” in the section where you enter your hours). Contact Payroll with questions: 330-941-1470, payroll@ysu.edu.

If you received a scholarship for housing during calendar year 2025, you will receive a tax form 1042-S sometime before March 15, 2026. This form will be made available through Sprintax, for those who set up their account (see Sprintax Calculus reference above). For those who do not setup a Sprintax account, the forms will be distributed through mail. Please follow this link to view and update your U.S. address in your Penguin Portal.

Tax Preparation Software

The Sprintax preparation software will ensure you are completing the appropriate tax forms as a non-resident for tax purposes. The Sprintax software has the capability of helping to prepare federal AND state taxes.NOTE: There is a cost associated with this software. Should you choose to use Sprintax software, you will be responsible for paying the fee.

DO NOT USE TURBOTAX, TAX29, H&R BLOCK, JACKSON HEWITT, TAXACT, or other tax preparation agencies/ software.

Please see a link to the Sprintax website with additional information below:

- Sprintax: https://www.sprintax.com/

- Sprintax knowledge base: https://www.youtube.com/user/Sprintax

- You may also find it helpful to review Sprintax’s blog on nonresident tax filing

- Sprintax free educational tax webinars:

Sprintax is hosting a number of free educational tax webinars that will be available to non-residents prior to and during the US tax filing season. You may register using the registration links below for a session that works well for you:- Feb 18th @ 3pm ET – Register here

- Feb 24th @ 10am ET – Register here

- Mar 5th @ 12pm ET – Register here

- Mar 11th @ 1pm ET – Register here

- Mar 16th @ 2pm ET – Register here

- Mar 27th @ 11am ET – Register here

- Apr 1st @ 1pm ET – Register here

- Apr 7th @ 8am ET – Register here

- Apr 14th @ 2pm ET – Register here

Sprintax e-forms available

When activating your Sprintax account, selecting Electronic 1042-S Consent, allows for your 2025 1042-S form to be available to you via your Sprintax account.

If electronic consent is given, a hard copy of the Form 1042-S will not be mailed. If electronic consent is not given, please make sure your current U.S. address is on file in your Penguin Portal for the Form 1042-S to be mailed.Volunteer Income Tax Assistance Program (VITA) – optional with limited appointments available.

PLEASE NOTE THAT VITA IS NO LONGER PREPARING FORM 8843 FOR STUDENTS WHO ONLY NEED THAT FORM COMPLETED. Students who need to file this form only (i.e., students who were present in the United States on any day during 2025 and did not have United States sourced income) will need to plan to complete their Form 8843 manually and mail it to the IRS or use SPRINTAX. VITA IS ALSO NOT PREPARING TAX RETURNS FOR STUDENTS WHO RECEIVE A 1042-S FROM YSU FOR HOUSING SCHOLARSHIPS. Students with housing scholarships will need to plan to use SPRINTAX.As mentioned during the international student orientation sessions at the beginning of the fall semester, international students in need of income tax filing assistance may register for an appointment to use YSU’s Volunteer Income Tax Assistance (VITA) program to prepare and file their 2025 tax returns.

When you register, please use your YSU student email address, not a personal email. Please keep in mind that these appointments are offered on a first-come, first-served basis. Once the appointment slots are filled, you will need to consider other options (i.e., Sprintax) for filing your taxes on your own.Registration is now available using the link below:

➜ Nonresident Alien VITA Tax Appointment Registration

Please note that the above link is the ONLY permitted link for international students. Students who registered using any other link provided from another source will be automatically rejected. Do not use links forwarded to you from someone else. Only the link provided here may be used.

You will select your appointment time online now, but you must come in person to that appointment in Williamson Hall. If you need to cancel your appointment, we cannot guarantee that another appointment will be available, so please make sure to schedule your appointment for a date and time to which you can commit.

You will need to bring the following documents with you to your appointment:- Passport

- Visa

- Social Security Card or ITIN Card

- Ohio Driver’s License (if you have one)

- I-94 with COMPLETE list of ALL dates you have entered and departed from the United States (not just 2025)

- Name and phone number for your YSU advisor

- Bank account routing number and account number

- W-2 form from employment

- 1099 form for scholarships

- 1042-S from YSU (if you have this form, you must plan to use SprinTax)

- Any other tax forms received

Be mindful of the tax filing deadline!

The tax filing deadline for 2025 taxes is April 15, 2026