Eligibility to work on campus

International students are eligible to work on-campus for up to 20 hours/week in positions that do not require the student have a federal work study award. Work study is a form of federal financial aid funded by the U.S. federal government; only domestic students are eligible. Some positions on campus require students to be eligible for work study, but many do not.

International students are eligible to work for companies that are not part of the University, but who do business on our campus. Because these employers are not part of YSU, their open positions may not appear in JobX. Students need to go to these locations and fill out an application. These employers include the following:

- The Barnes and Noble bookstore on the YSU campus located at the corner of 5th Avenue and Lincoln Avenue

- Dunkin Donuts on the YSU campus located in Kilcawley Center

- Chic-Fil-A on the YSU campus located in Kilcawley Center

- Christman Dining Hall (located by the Cafaro House residence hall) and on-campus restaurants operated by Chartwells, YSU's dining service company. The Chartwells' office is located in Kilcawley Center

To be eligible for employment during the fall or spring semesters, a student must be enrolled for a minimum of two courses and no less than six credit hours and be in good academic standing. Audited classes do not count toward either the two course or six credit hour requirements.

To be employed during a summer semester without concurrent summer enrollment, the student must have been enrolled during the previous spring, be currently registered for the upcoming fall and be in good academic standing.

How to find and apply for a job on campus

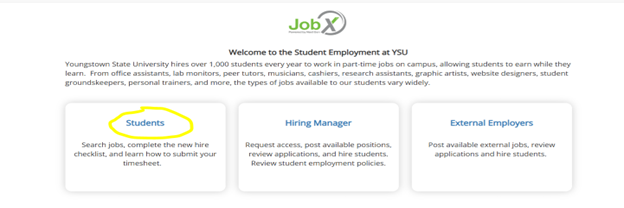

On-campus student positions are posted on JobX, YSU's job posting platform for all students. All YSU students have a free JobX account.

1. Find and click on the “On campus Student Employment Opportunities” card on the YSU Portal

2. Select “Students”

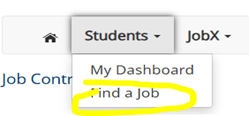

3. Select “Find a Job” from the drop-down menu

The hiring process

If you have worked for YSU before, your supervisor will contact you when you have officially been hired. At this point, you may arrange your schedule and begin working.

If you have not worked for YSU before, the Student Employment Office will contact you with instructions on how to complete the hiring process. Once these steps are complete, your supervisor will contact you and you may begin working.

Step 1. Complete Required Hiring Forms

Students must complete and return the following forms to Student Employment:

- Confidentiality Acknowledgment

- School District

- Authorization for Direct Deposit of Pay

- Statement Concerning Your Employment is a Job Not Covered by Social Security

- Student Employees of Ohio Public Employee Retirement System (OPERS) Membership

Please follow the below procedure so that the forms remain as fillable forms:

- Download a form

- Fill in requested information

- Use SAVE AS to save the form to your computer as a new document

- Repeat process for each form

Step 2. Provide Proof of Eligibility to Work in the U.S.

Once Student Employment has received and reviewed all forms, you will be asked to schedule an appointment to verify your eligibility to work in the U.S. This is the final step in the hiring process, and it must be done in person. You must bring the following original documents (not copies) to the appointment:

- Valid passport

- I-20

- I-94

- YSU student ID

SOCIAL SECURITY CARDS

International students do not need a Social Security Card to be hired and start employment, but they will need to obtain one after being hired. For information, visit how to apply for a social security card.

Student employee responsibilities

Student employees are responsible for:

- following policies and procedures as identified by their supervisor

- abiding by general University policies at all times, including but not limited to the Student Code of Conduct.

- accurately recording hours on their time sheet

- submitting their time sheet on time. Instructions on how to fill out a timesheet are available at is: https://ysu.teamdynamix.com/TDClient/2000/Portal/KB/ArticleDet?ID=135913

- adhering to the agreed upon work schedule

- NOT WORKING MORE THAN THE TOTAL ALLOWABLE HOURS EACH WEEK

- not scheduling work during class time

- informing their supervisor in advance if they are unable to work

Paying income tax in the u.s.

Students in the USA on F-1 visas ARE REQUIRED to pay both federal and state income taxes. These taxes are withheld from your pay and you must file a tax return as part of the process. International students are NOT required to pay employment taxes (i.e. Social Security and Medicare, also known as FICA).